The Cook, The Boss & The Blackberry

This week’s return to work for most is a good time to act on our reflections over Christmas and think about the implications for the future we want to create.

Personally I was struck by three items of early New Year news which have caused me to think:

Apple became the first company to achieve a market valuation of $3trillion on 3rd January

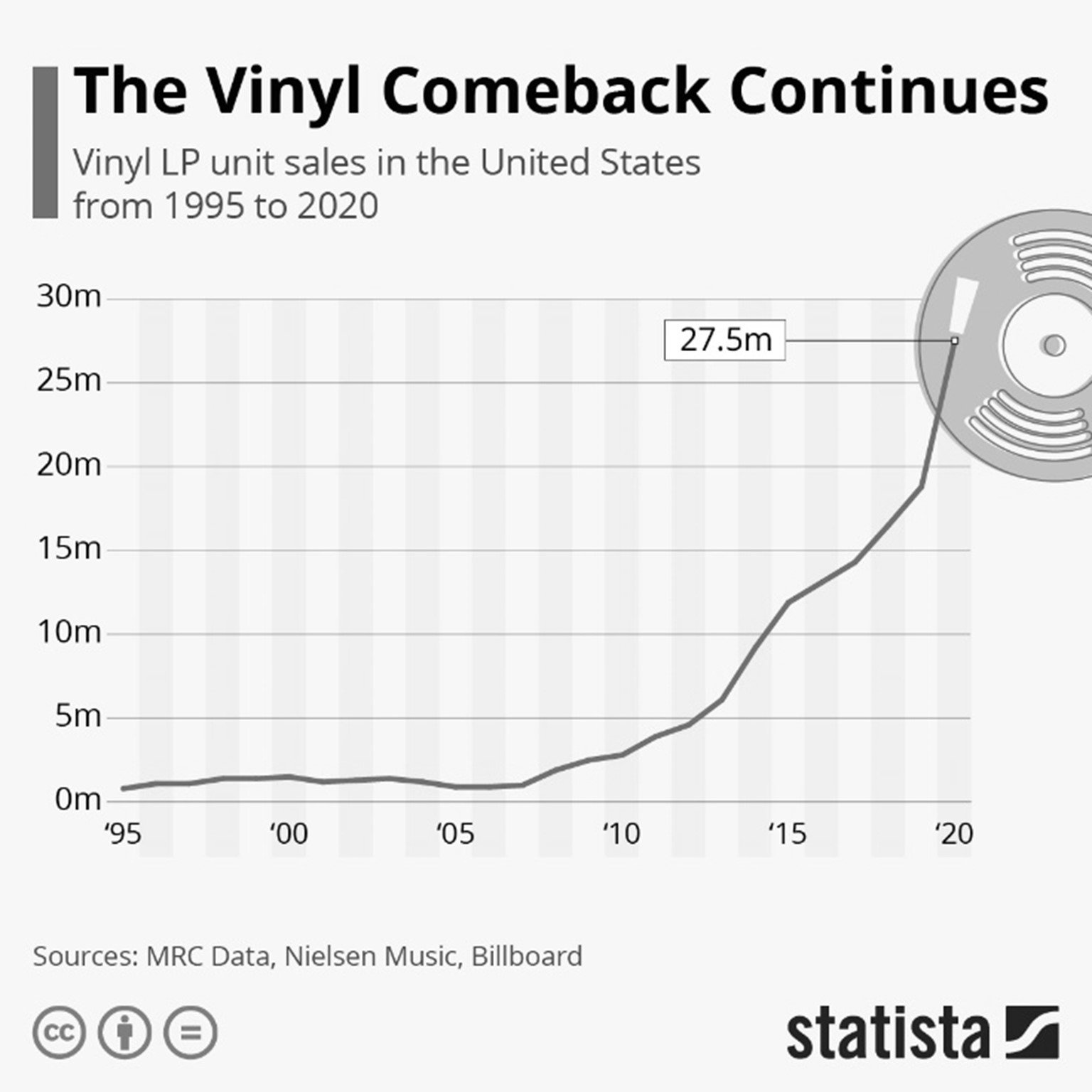

Over the holidays Bruce ‘The Boss’ Springsteen sold his back catalogue to Sony Music for $500m. At the same time vinyl sales in the UK hit a three-decade record high

Blackberry finally stopped all support for its operating system this week, marking the final death rattle of its once dominant device which had 85m users in 2009

I have been considering the lessons from these events and three things come to mind.

Competitive strategy can be reframed

Despite predictions to the contrary, Apple has flourished under Tim Cook who has presided over an increase in its share price of more than 1,200% since the days of founder Steve Jobs. In recent years Apple is becoming viewed increasingly by investors as a service-based stock. Cook perhaps recognising an over-reliance on iPhone hardware sales has presided over a major growth in software sales, including the recent promotion of subscription services, albeit still largely dependent on the iPhone user base. It shows how a great business can continue to reinvent itself if it keeps its brand strong and is aware of and responsive to the risks and opportunities in a constantly changing competitive context.

Predictions of an industry’s demise can be exaggerated if new opportunities are embraced

After years of stories about the demise of the music industry, the threats of streaming and depleting margins, today a growing number of artists are capitalising on a new investor trend. Investors have spotted the long-term income returns good songs can offer through streaming. Private equity firms, pension funds and others have invested $13b in the last year alone in such music assets. In the process transforming the hits of yesteryear into a new asset class. There is even speculation that music bonds could make a prominent return. David Bowie paved the way 25 years ago securitising the rights of his royalties and offering a ‘music bond’ with a fixed annual return of 7.9% over 10 years.

The lesson here is that great brands and good products have enduring value even if releasing their value in changing circumstances requires a little ingenuity and imagination.

Don’t look at your feet

Blackberry’s lesson is almost the reverse of Apple’s. Failure to innovate and understand the allure of touch screens, a myopic focus on the business customer when Apple’s iPhone was about to unite customer and business user needs and sticking for too long to an inflexible operating system while Apple actively encouraged App developers. All combined to turn 85m users into virtually nil in less than 10 years.

It’s stimulating to think that despite the doom and gloom of the ‘Covid years’ we enter 2022 with everything still to play for, with prospects limited only by our energy and ingenuity.

Happy New Year!